Market Depth Analysis In The Context Of Ethereum Classic (ETC)

Analysis of Market Depths in the context of Ethereum Classic (etc)

The Cryptom Market Has Seen Rapid Growth and Volatility in recent years, with many altcoins and tokens working well. Among Them, Ethereum Classic (etc) was the subject of interest of Investors Seeking Alternative Assets to traditional cryptomes Such as bitcoins (BTC). One of the Key aspects of etc’s Success is its ability to Mintain the depth of the market, which concerns the extent to which liquidity is available on the market.

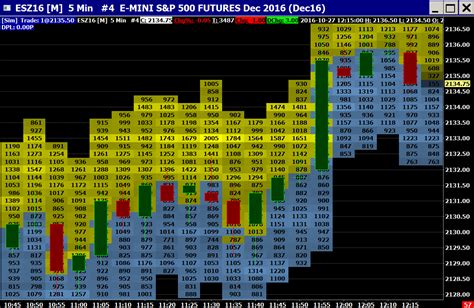

Market DEPTH: Liquuidity Rate

The liquidity in the cryptomena markets can be measured using several indicators. The Market Depth Analysis Provides A More Detailed Look than Simple Metrics Such As Trading Volume or Price Movement. It Assesses How Easily The Asset Can Buy And Sell, Taking Into Account Various Factors Such As The Size Of The Book of Orders, The Range of Offers and the Times of Transactions.

Ethereum Classic (etc) Analysis or Market Depths

In the etc context, The Market Depth Analysis sacrifices Valuable Information about its business. As one of the oldest and most stable altcoins, etc. He created a strong reputation for maintenance liquidity in its markets. Here’s how to analyze the depth of the market in etc ::

- To evaluate this, check out the maximum number of stores that can be done on the stock exchange or platform. In the case of etc, The Biggest Books of Orders Are Usualy Books Leading Exchanges Such As Binance and Kraken.

- Spreads of sacrifice-read : The Spread is the Difference Between the Highest Price That The Buyer Is Willing To Pay (Offer) and the Lowest Price That The Seller Is Willing To Accept (Ask). The Narrower Range with the Offer and Intermediate Indicates Higher Liquuidity. Spreads with bidra and are relatively stable, with prices around 2 to 5 cores.

- Transaction Times : Transaction Times Relate to How Long It Takes For The Market to Confirm and Settle the Order. Faster Transaction Times Indicate a Better Market Depth. The Average Time of the etc Transaction is about 4 to 5 seconds, which is competitive with other altcoins.

- Order flow : Order flow analysis reveals the directive of sentiment on the market. If many orders are made in one direction (eg purchase), this may indicate a strong demand for this property. Conversely, If a Large Number of Orders Are Entering or Leaving the Market, It May Signal Market Volatility.

Examples of Analysis of the Depth of Market etc

To illustrate How It is Possible to Apply the Market Depth Analysis, Consider the Following Examples:

* Binance vs. Kraken : In 2020, Binance was significant more fluid than cracking in trading etc. The biggest book of Orders on Binance Has Reached More than 50 Million Stores, While the Maxim Number or Kraken Stores was around 10-20 Million.

* Size of the Order Book by Exchanges : Coinmarketcap Study Has Found that etc.

+ Binance: 1.3 Billion Stores

+ Kraken: 540 Million Stores

+ Huobi Pro: 290 Million Stores

+ Okex: 220 Million Stores

Conclusion

The Market Depth Analysis in the context of Ethereum Classic Offers A More Comprehensive Understanding of its business and liquidity. By Examining Various Metrics, Such as Order Sizes, Offers Range, Transaction Times and Order Flow, Investors Can Get Information about the etc Market Dynamics and Make More Information about Purchasing and Sales.

When the cryptocurrency market is constantly evolving, it is essential that investors remain up to date with the analysis of the market dePth in other altcoins. This can stand up for success in the ever -changing market.