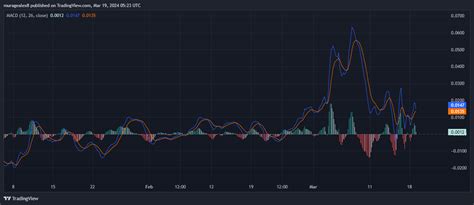

MACD For Crypto Traders: How To Use It Effectively

MacD for crypto traders: unlock the power of the momentum and the analysis of trends

The world of cryptocurrency trading has changed considerably over the years, new technologies and tools emerged regularly. Such a tool that has gained popularity among traders is the divergence of Mobile Average Convergence (MACD). In this article, we will immerse ourselves in the bases of MacD, its applications in the trading of cryptocurrencies and provide advice on how to use it effectively.

What is MacD?

The MacD is a technical indicator developed by J. Welles Wilder Jr. in the 1990s. It is a momentum oscillator that measures the relationship between two mobile averages (MA) of different periods. The MacD consists of two main components:

- Mac (Mobile average convergence) : This represents the difference between two MA lines, one with a shorter period and another with a longer period.

- Signal line : This is an exponential weighted average line which converges towards the Mac line.

How does MacD work?

The MacD uses these two components to generate several signals:

- The Mac line crosses the signal line when it is positive, indicating a potential purchase signal.

- When the Mac line crosses the signal line, it indicates a sales signal.

- A false breakup occurs when the Mac line exceeds or below the signal line while being in an upward trend or a downward trend, respectively.

MacD applications in the trading of cryptocurrencies

MacD is particularly useful in trading of cryptocurrencies because it provides valuable information on market trends and momentum. Here are some ways to use MacD effectively:

- Trendy identification : MACD can help identify trends by detecting when the Mac line crosses above or below the signal line, to signaling the purchase or potential selling signals .

- Conversion of volumes as a price : By combining MacD with other technical indicators such as RSI (relative force index) and Bollinger bands, traders can obtain more precise predictions of price movements.

- Momentum analysis

: The MacD can be used to analyze the momentum on the markets of cryptocurrencies by identifying when the signal line crosses or below the Mac line, indicating a potential reversal of the trend .

How to use MacD effectively for Crypto merchants

To start with the effective use of MacD in cryptographic trading:

- Choose the right deadline : Select a period suitable for your trading style and your risk tolerance (for example, graphics of 4 hours, 1 hour or 1 day).

- Adjust the settings : Set the Mac period (usually 12-26), the length of the signal line and other parameters according to your strategy.

- Combine with other indicators : Use MacD in conjunction with other technical indicators such as RSI, Bollinger Bands and mobile averages to create a more complete trading plan.

- Monitor and adjust : Continue continuously the MacD lines and adjust your trading strategy as market conditions change.

Best practices for trading with MacD

To maximize the efficiency of the MacD in cryptographic trading:

- Stay emotional inflexible : Avoid emotional decisions based on short -term movements or emotions.

- Focus on fundamental principles : favor fundamental analysis on technical indicators and news.

- Use support and resistance : Identify the key support and resistance levels using technical indicators such as RSI and Bollinger strips.

- Be patient

: MacD signals are not infallible; Be ready for false eruptions or inversions.

Conclusion

MacD is a powerful tool that can help cryptocurrency traders better understand market trends, momentum and potential negotiation opportunities. By understanding how to use MacD effectively and combining it with other technical indicators, traders can increase their chances of success in the markets. Do not forget to stay patient, flexible and informed, and you are always ready for unexpected price movements or market changes.