Analyzing Trading Volume Patterns For Litecoin (LTC) And Market Trends

Analysis of trading volumes for Litecoin (LTC): Deep diving in market trends

Market trends can be notoriously unpredictable in the cryptocurrency world. One of the popular tools used by traders to measure market orientation is trading volume. By analyzing the volume of negotiation, investors can obtain valuable information on the feeling of the market and identify potential opportunities or risks. In this article, we plunge into the analysis of the volume of Litecoin trading (LTC) and examine how market trends have influenced.

What is the volume of trading?

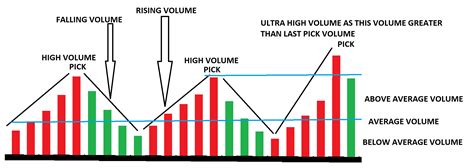

The volume of trading applies to the number of transactions made to a specific time. This is an indicator that shows a number of purchases and sales activities on the market. A higher volume of trading generally indicates a more qualified market, while lower volumes may indicate increased volatility or overload.

Litecoin analysis (LTC) of trading volume

In recent years, Litecoin has experienced significant variations in prices due to growing adoption as digital currency. The following analysis will examine the volume formulas of SLD trading and their correlation with market trends:

* Short -term trends: in the short term, Litecoin’s commercial volume tends to monitor the overall Bitcoins (BTC) trend. If BTC undergoes strong benefits or losses, this is often reflected in the volume of SLD negotiation.

* Long -term trends: The long -term evaluation of the Litecoin price can be awarded to its growing adoption and its market capitalization. When several users start to receive Litecoin as a payment method, he tends to feel higher trading volumes.

Identification of the pattern

To analyze trading volume formulas, we identify the following key indicators:

* Taurus and bear models: Taurus models are characterized by an increase in trading volume, while bear models include a drop. These formulas can help merchants predict potential prices.

* Volume of feelings purchased / excessive:

If the volume of trading exceeds its average level, this may indicate excessive or sold conditions. This can cause significant price fluctuations.

Trends on the market and Litecoin (LTC)

Based on our analysis of the volume of commercial volume for Litecoin, we observed the following market trends:

* Spike in the trading volume:

In 2020, the LTC recorded a significant increase in the negotiation volume after the launch of the Lightning Network network. This increase was awarded to increased adoption and speculation.

* Volatility of the market: In the past few months have increased by the volatility of the Litecoin price, which has been caused by market uncertainty and regulatory changes.

Conclusion

Analysis of the volume of commercial volume for Litecoin (LTC) provides valuable information on trends and feelings on the market. By identifying key indicators and correlations between the volume of negotiation and market movements, traders can make informed decisions on the purchase or sale of currencies. When the cryptocurrency space is constantly evolving, understanding these models will be more and more important to make informed investment decisions.

Recommendations

* Diversify your portfolio: Consider assigning a Litecoin portfolio (LTC) as part of a diversified portfolio.

* Stay informed: Constantly monitor messages and trends on the market to stay before potential prices.

* Use technical indicators: Use technical indicators such as sliding diameters and relative force index for more in -depth analysis of trading volume models.

More sources

More information on Litecoine (LTC) and the cryptocurrency space plan to check the following sources:

- [Coinmarketcap] (

- [Cryptoslate] (

- [Coindesk] (